Filter Resources

Resources

Tell GSBC About Your Bank’s PPP Efforts

We are attempting to collect information related to community banks’ support of jobs and general conditions in their local trade areas as a result of the recent Payment Protection Program (PPP), and we need your help.

The Legacy of Gaylord Jentz

Guest Post by GSBC Faculty Member Roger Guerin: “It is the faculty that makes the Graduate School of Banking at Colorado what it is today,” often states Graduate School of Banking at Colorado (GSBC) President Tim Koch, and I believe this to be of the utmost truth.

Cheers to 70 Years! A Poem by the GSBC Bank Simulation Team

Guest post by the GSBC Bank Management Simulation faculty (Becky Buhr, Jonathan Finley, Roger Guerin, Perry Haralson, Michelle Hodge, Brent Klanderud, Jeff McDonald, Cathy Morrissey, Lance Nunn and Kathy Schwerdtfager).

GSBC Faculty: Who’s Behind the Instructor?

GSBC faculty members hail from across the country to come to Boulder each July. They help shape community bankers’ careers and futures, and make lasting impacts on every student they teach.

The Results Are In! GSBC Alumni’s Boulder Memories

We asked, and GSBC alumni delivered! Since they spent a total of six weeks (42 days!) in Boulder, we wanted to know the lasting impression Boulder had on our former students.

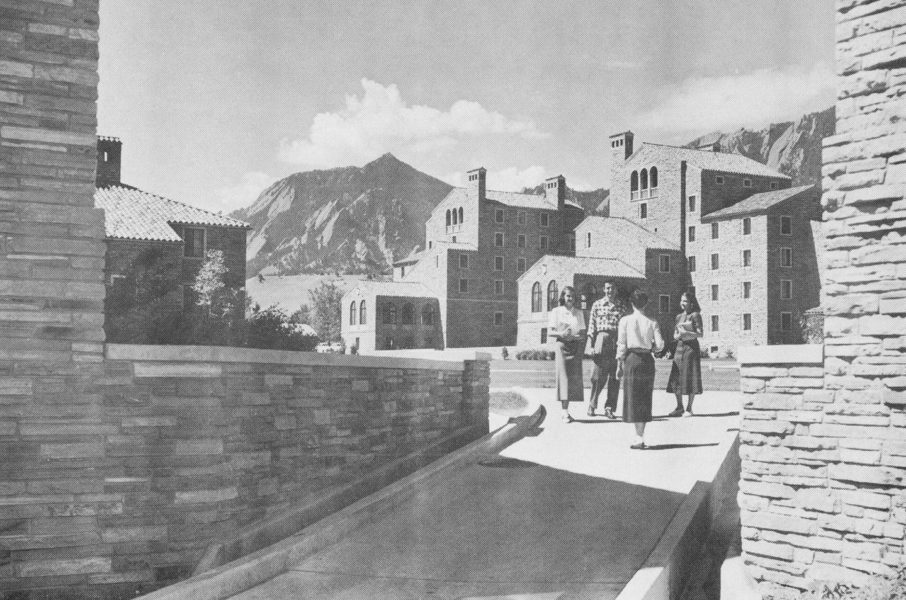

GSBC at CU Boulder: Then & Now

The University of Colorado Boulder has served GSBC well since the school’s founding in 1950, and has provided GSBC students an immaculate campus to learn and network.

Let’s Celebrate! GSBC Turns 70

For 70 years, the Graduate School of Banking at Colorado (GSBC) has been America’s premier community banking school. Since 1950, GSBC has been entrusted by the financial services industry to develop its leaders with world-class education and unmatched networking opportunities, all at the foot of the Rocky Mountains.

Podcast: What is the First Step to Developing a Sound Investment Strategy for Bond Portfolio Management?

Tune into this podcast with Community Bank Investments School faculty member, Chris Nelson, to explore fixed income investments, portfolio management and more. In the show, he will help you learn how to use your investment portfolio more effectively to help your institution meet its goals and optimize its performance. Above all, you’ll take away from…

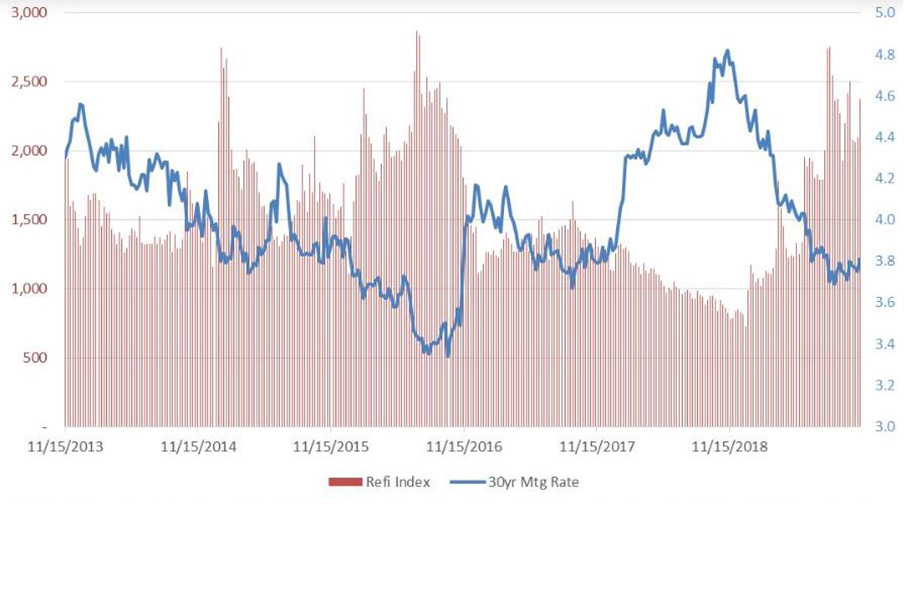

Investment Strategy: Risk/Reward With Mortgage Investing

Bankers track many key interest rates, but surely mortgage rates get a lot of attention, as they can have a significant impact on a community bank’s earnings and profitability. Residential mortgage loans typically represent a meaningful earning asset for many financial institutions. Additionally, an average bank investment portfolio often holds an allocation of mortgage products, the…

2020 Gold Rush Referral Program

GSBC’s prime enrollment period is here, and you can get rewarded for helping in our recruitment efforts! Alumni and students are eligible to earn two tiers of rewards by referring colleagues and fellow community bankers to GSBC’s core programs: 70th Annual School Session Executive Development Institute for Community Bankers® Community Bank Investments School How to…

The Meaning of Excess Reserves in Today’s Financial System

At the September Federal Open Market Committee meeting, the Fed felt that, with “ample reserves” in our banking system, they could orchestrate a cut in the federal funds rate (the interest rate on overnight reserves exchanged between banks) by simply announcing the new lower target for the funds rate to be in the range of…

Unplugging the Dam – Working Faster Payments into Business Receivables

The question you need to ask your treasury services department is, “Are we initiating the conversations with our business customers that will highlight ways we can be strategic?”. Instant payments may only look like a trickle now, but by taking a strategic approach to solving the current problems of today, your business will be prepared…