This past December, the Federal Reserve raised the federal funds rate target to between 1.25% and 1.50%. While two of the Fed presidents voted against the decision due largely to concerns that inflation and wage gains were still small and below expectations, Fed Chair Janet Yellen and the others referenced a strengthening labor market and growth in the aggregate economy to support the rate rise. Economic data released since the December decision have, in turn, created considerable uncertainty regarding the path of U.S. interest rates going forward.

Consider the following recent announcements:

- The consumer price index (CPI) for 2017 increased 2.1% year-over-year.

- The core CPI for 2017 increased 1.8% year-over-year.

- Nonfarm payrolls grew by 148,000 in December to where the 2.1 million jobs were created in 2017. Manufacturing jobs represented 196,000 of this total, the most since 2014.

- The headline (U3) unemployment rate remained at just 4.1% (U6 at 8.1%) in December with a labor force participation rate of just 62.7%.

- Weekly and hourly wages increased by 2.8% and 2.5%, respectively in 2017 compared with 2016.

- Retail sales rose 4.2% in 2017 with retailers having their best holiday sales since 2010.

- The U.S. continues to run a large trade deficit.

What do all of these figures say about future inflation? Importantly, there appears to be an emerging consensus that U.S. inflation will increase in 2018 thereby forcing interest rates higher over time. There also appears to be general agreement that the Federal Reserve will raise the fed funds target at least two more times in 2018. If rates, in fact, rise over time, the long-term bull market in bonds – evidenced by falling rates – will be (at least temporarily) over.

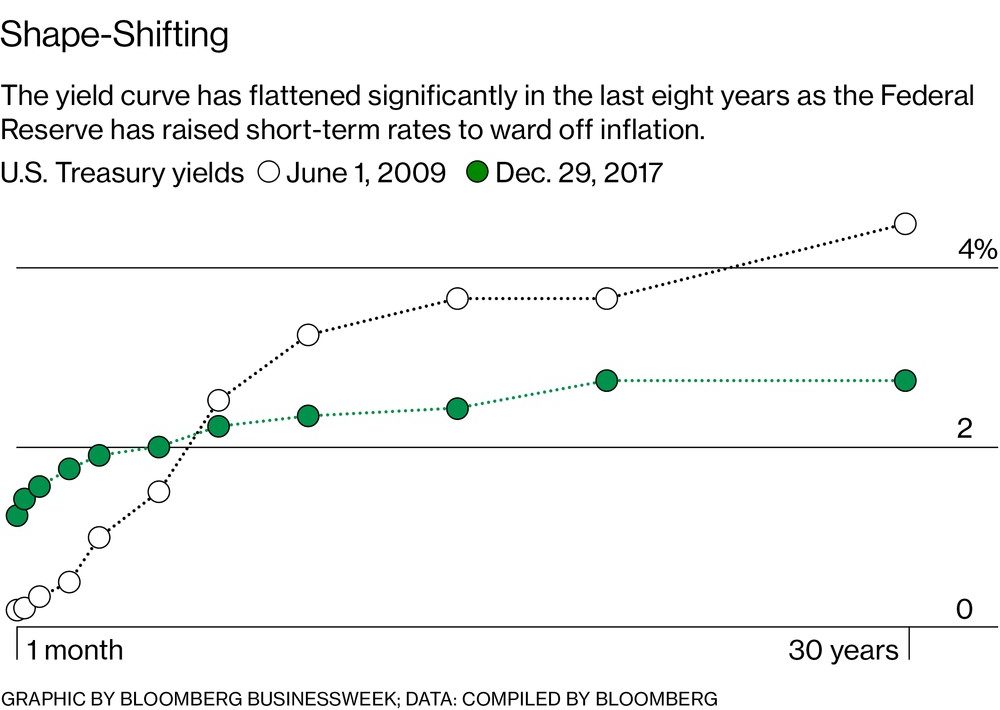

Bond investors are concerned about how realized (and expected) rate increases will affect current portfolio values and how they might best assess investment opportunities and funding alternatives given the uncertain environment. While U.S. interest rates have generally moved higher in recent months, they have not increased by the same amounts across maturities. In October 2017, Barron’s lead article focused on the declining spread between the 10-year and 2-year Treasuries. Bloomberg BusinessWeek similarly linked the flattening of the yield curve (see Exhibit 1) to the possibility of a recession. However, most economists believe that the likelihood of a U.S. recession is low.

In contrast, during the second week of January 2018, bond guru Bill Gross of Janus Henderson Group cited the 7 basis point ‘jump’ in the 10-year rate and corresponding steepening of the Treasury yield curve in declaring a formal beginning of a bear market in bonds. Around the same time, rumors circulated –only to be denied later – that China was going to halt or at least slow its purchases of U.S. Treasuries. Not surprisingly, rates temporarily jumped only to stabilize later with subsequent Treasury auctions running smoothly. These announcements coincide with reports that Treasury borrowings will increase as the Fed reduces its balance sheet. Finally, many large firms are responding to the new tax law by paying taxes on income that they attributed to foreign operations. Because these profits are often held in the form of U.S. Treasury and corporate bonds, the freeing up of these proceeds will allow the firms to sell their holdings or, at least, stop purchasing additional Treasuries and corporates. Either choice will put upward pressure on rates unless other investors replace the demand especially given the expected growth in supply from rising federal deficits.

Clearly, uncertainty is growing which creates volatility in interest rates. A true bear market in bonds should move rates systematically higher over time.

Exhibit 1

Whatever your forecast for interest rates is, the Fed appears to be supportive of increasing the fed funds target again in 2018. If economic growth leads to inflation above the Fed’s 2% target, the rise in rates will accelerate. Given the uncertainty, community bankers should:

Investment Portfolio

- Review the mix of existing investment security holdings with regard to

- Types of instruments (Treasuries, Agencies, Municipals, Mortgage-backeds, etc.)

- Maturities / Durations

- Existence and trigger points for option exercise

- Understand the potential market value depreciation of the portfolio if rates rise by various amounts (+1%, +2%, …)

- Understand the potential impact on net interest income and net income if rates rise

- Review investment policy objectives and related guidelines in the event that action is appropriate

Deposit, CD & Wholesale Funding

- Review the mix of core deposits versus likely surge deposits with regard to

- Length of customer/depositor relationship

- Number/breadth of products and services actively used (primary relationship if you have the transactions account)

- Residence of home/business within the trade area

- Review the mix of non-core liabilities

- Effective maturities/durations

- Level of rates paid

- Existence and trigger points for option exercise

- Collateral available for pledging

- Understand the potential impact on the mix of funding, net interest income, and net income if rates rise

- Consider issuing longer-term CDs in anticipation of rising rates

- Review investment policy objectives and related guidelines in the event that action is appropriate

Planning will help identify steps to rebalance the existing investment portfolio as well as allow for the opportunity to take advantage of new investment opportunities. It will also help the bank to better manage its funding costs over time. Both general strategies will enhance bank value.

[1] Source: Coy, Peter, “A Tale of Two Curves,” Bloomberg Businessweek, January 8, 2018

[1] Lefrancois, Andre, “Bill Gross Calls Bond Bear market as 1-Year Yield Passes 2.5%,” www.newsmax.com, January 10, 2018.

[1] Large U.S. based technology firms hold an estimated one-half trillion dollars in U.S. Treasuries and corporates. See “When Apple’s Cash Comes Home,” Liz Capo McCormick and Molly Smith, Bloomberg BusinessWeek, January 22, 2018.

by Timothy Koch, President, Graduate School of Banking at Colorado